Cedar County Collector of Revenue

Pay/Search Taxes Online

*A credit card convenience fee of 2.5% applies to all online payments.

*Search by entering last name first, i.e. Doe John, or by business name on tax bill.

*Please allow 7-10 days to receive receipts.

| Pay/Search Online |

Duties of the County Collector

About Your Taxes

Cedar County Collector of Revenue

Lisa Nelson

What are the Duties of the County Collector?

The Cedar County Collector of Revenue is an elected official responsible for collecting current and delinquent property taxes for political subdivisions within the county. These are state approved property tax levies. The Collector is bonded. We strive to serve the taxpayers of Cedar County with friendly service and updated technology.

The Collector is Responsible for:

- Collecting and distributing railroad and utilities, real estate, and personal property taxes.

- Bankruptcy Payments

- Pre-pay Payments

- Mailing of Real Estate and Personal Property Tax Statements

- Mortgage Company Payments

- Issuing Merchants Licenses

- Conducting delinquent land tax sale the fourth Monday of August each year

- Issuing certificate of purchase, tax sale redemption and tax sale issues.

About Your Taxes

Real Estate and Personal Property taxes are levied annually and the statements are mailed out in November. Tax Payments are due by December 31st of each year, if paying by mail the postmark determines the month paid. Payments postmarked received after December 31st must include penalty and interest charges. If a tax bill is not received by December 1st, please contact the collector's office at 417.276.6700 Ext. 224. Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. If you are paying taxes after December 31st, please refer to the delinquent payment chart on the right side of the statement.

Real Estate Taxes:

The tax liability on real estate remains with the property.

Personal Property Taxes:

Taxes are assessed as of January 1st. Taxes are due for the entire year regardless if the property is no longer owned or has been moved from Cedar County. State law requires that personal property taxes be paid before license plates on a vehicle can be issued or renewed. The Department of Revenue, License Bureau accepts a paid tax receipt to verify that taxes have been paid.

Pre-Pay Statements:

Prepay statements are based on last years tax amount. There will be nine equal installments with the final installment being the balance of the tax due. Cut-off date for monthly payment is September 30. Please send only the amount shown as the monthly payment or you can make more than one payment at a time just double the amount of the monthly payment. Your regular statement that comes out around the 1st of November will show the amount that has been prepaid and the balance due. Regular statements will need to be paid by December 31st in order to prevent penalty.

If interested, feel free to contact the Collector's office during business hours.

Cedar County Health Department Announcements

New Stockton Location

We are so excited about this opportunity to open our Stockton location! We have moved inside the Cedar County Health Complex out on Owen Mill Rd. At this time, we are offering WIC services by appointment through this office, but we look forward to adding additional services soon. We are still in our El Dorado Springs location, so if you have any questions, come see us or feel free to call us at (417) 876-5477.

Thank you to the Cedar County Memorial Hospital for giving the Cedar County Health Department a space to put up this billboard for Texting and Driving Awareness.

Over the next five years, the Cedar County Health Department will promote Buckle Up Phone Down as part of their work with the Maternal Child Health Services through the state of Missouri. They have chosen this program due to the dangerous epidemic of texting while driving that strongly increases the risk of everyone on the roads. At any given moment, 660,000 drivers are using a cell phone while operating a vehicle. Every year, about 400 fatal crashes are caused by texting and driving, according to the National Highway Traffic Safety Administration's (NHTSA) 02/16/2022 article, Texting and Driving Statistics 2022. Our goal is zero deaths on our roadways. You can save your life and others by practicing these two simple measures. Buckle Up and Phone Down

No Joke Totes!

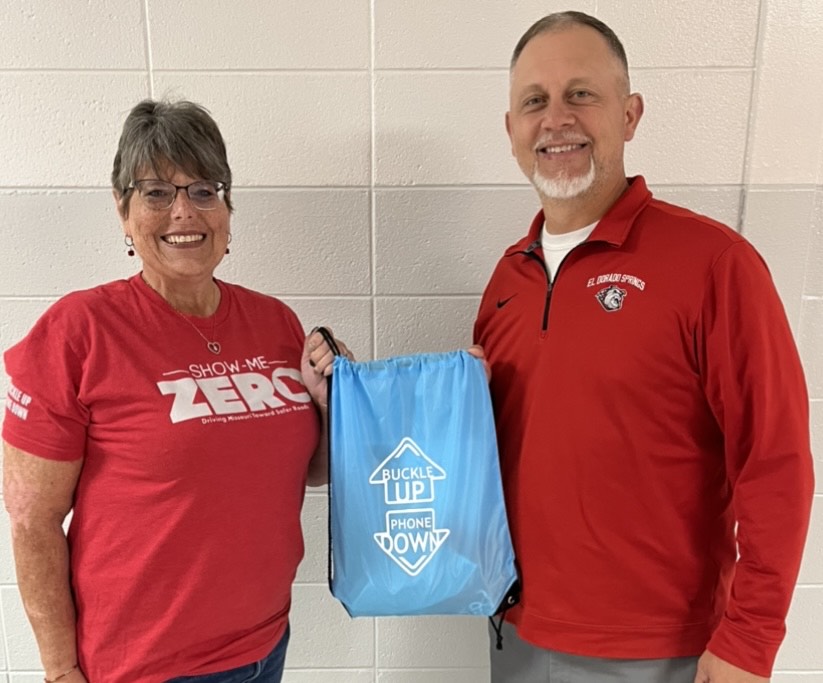

In our society, getting a driver’s license is a milestone in life. It is exciting! However, we frequently fail to stop and think just how dangerous driving can be when we are careless and choose to allow distractions while we drive and/or choose not to obey simple traffic laws. The Cedar County Health Department is working under a Maternal Child Health grant to help decrease childhood injury through encouraging safe driving practices. One of our activities was to give the sophomores of Cedar County bags with safe driving tips and items with safe driving messaging, “No Joke Totes”. On 11/01/2022 we were at the El Dorado Springs High School and had a short discussion of safe driving practices with sophomores in five different history classes and gave out a total of 99 “No Joke Totes”. On 11/08/2022 the Cedar County Health Department had a short assembly with the Stockton High School sophomores discussing safe driving practices and gave out 79 “No Joke Totes”. Later that day, we talked with five sophomores and gave them each a tote at the El Dorado Springs, MO Christian School. The Cedar County Health Department looks forward to working with county to help keep our children safe. (Pictured First: Hollee Waller, RN & Kelly Bryson, Principal of El Dorado Springs Christian School) (Pictured Second: Hollee Walker, RN & Jim Flora, Principal of Stockton High School) (Pictured Third: Hollee Walker, RN & David Rotert, Principal of El Dorado Springs High School)

COVID-19 Data Reports:

- March 2022 COVID Report

- 06/06/2022 COVID Report

- 07/11/22 COVID Report

- 08/15/22 COVID Report

- 09/12/22 COVID Report

- 10/03/22 COVID Report

- 10/11/22 COVID Report

- 10/24/22 COVID Report

- 10/31/22 COVID Report

- 11/07/22 COVID Report

- 11/15/22 COVID Report

- 12/05/22 COVID Report

- 12/12/22 COVID Report

- 12/19/22 COVID Report

- 12/23/22 COVID Report

Right-HealthDept

Contact

Primary Phone and WIC: 417-876-5477

Primary Fax: 417-876-5017

Victoria Barker, Director/WIC Coordinator

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Primary Address:

1317 S. Hwy 32, Suite B

El Dorado Springs, MO 64744-2037

Satelite Address:

807 Owen Mill Rd.

Stockton, MO 65785

Office Hours

8:00 - 4:30 (Monday - Friday) El Dorado Springs

8:30 - 4:00 (Monday's Only) Stockton

Staff

Taylor Austin, Registered Nurse

Gina Bachand, Assistant

Joyce Heuser, Contact Tracer

Cheryl Lusk, Registered Nurse

Hollee Walker, Registered Nurse

Christopher Young, Environmental Specialist

Court Costs Schedule

28th JUDICIAL CIRCUIT COSTS

(Effective 07/01/2021)

Attorneys are responsible for service and service fees. All pro se filings must deposit additional funds to cover service fees.

CIVIL

- Circuit Civil $100.50

- Expungements require additional surcharge $250.00 ($350.50) FILING FEE

- Domestic Relations $102.50

- Adoption $183.50 (includes $15.00 processing fee and $15.00 for first certified copy)

- Associate Civil $ 48.50

- Small Claims $ 80.50 + $30.00 for each additional Dft for service

- Small Claims with service by certified mail $ 20.50 + certified mail cost

- Small Claims Trial De Novo $ 45.00

- Termination of Child Support $ 7.53

PROBATE

- Decedent Estates $148.50 + $35.00 if admitting will

- Incapacitated/Disabled Estates $108.50

- Minors' Estates $ 93.50

- All other probate $ 68.50

- Receiving Will $ 3.00

- Admitting Will $ 68.50

- Refusal Letters $ 68.50

- Small Estate $ 68.50

*Sheriff service for other counties may be different - you will need to check on that*

Election and Voter Registration Information

Voter Registration

Register To Vote

http://www.sos.mo.gov/elections/govotemissouri/register

Where Do I Vote?

https://s1.sos.mo.gov/elections/pollingplacelookup/

How To Vote

http://www.sos.mo.gov/elections/goVoteMissouri/howtovote

What do I bring to the Polls?

http://www.sos.mo.gov/elections/goVoteMissouri/howtovote#forms

Absentee Voting

http://www.sos.mo.gov/elections/goVoteMissouri/howtovote#absentee

Military and Overseas Voting Access Portal

http://www.sos.mo.gov/elections/goVoteMissouri/registeroverseas

Accessible Voting

http://www.sos.mo.gov/elections/goVoteMissouri/howtovote#accessible

Missouri Election Laws

https://www.sos.mo.gov/CMSImages/ElectionGoVoteMissouri/CurrentElectionLawBook.pdf

Federal and State Election Results

Missouri Election Results http://www.sos.mo.gov/elections/s_default

County Election Results https://enr.sos.mo.gov/CountyResults.aspx

Election Integrity Unit

http://www.sos.mo.gov/elections/elections_integrity/

Frequently Asked Questions

http://www.sos.mo.gov/elections/goVoteMissouri/questions

Election Public Service Annoucement

https://mosecretaryofstate.sharefile.com/share/view/s5f4e052fde5f4d8d9819a56db285faa0

Financial Statements

2022 Cedar County Financial Statement Publication

2021 Cedar County Financial Statement Publication

2020 Cedar County Financial Statement Publication

2019 Cedar County Financial Statement Publication

2018 Cedar County Financial Statement Publication

2017 Cedar County Financial Statement Publication

2016 Cedar County Financial Statement Publication

2015 Cedar County Financial Statement Publication